From $5 meal deals to new value menus, 2024 was a year of promotions. Chains deployed value offerings to try and revive sluggish traffic, and brands like McDonald’s and Taco Bell saw boosts in transactions and sales as a result.

“Value and price will remain hot button items for consumers in 2025,” Jeffry Pielusko, managing director of Carl Marks Advisors, wrote in an email. “The 2024 election demonstrated that consumers are hyper focused on the economy and rising prices. In the year ahead, operators who can continue to innovate in an environment where customers are price sensitive will be the winners.”

Value in 2025 will evolve beyond a competition for the steepest discounts, especially as some operators see margin compression. Experts said restaurants will focus more on quality and menu innovation to attract diners.

About 60% of respondents to a November TD Bank survey, which drew input from restaurant operators and finance professionals, said they saw a boost in traffic with value meals, offsetting the 40% who said they experienced margin compression.

“[Value meals] are designed for one thing and that’s to maintain or increase traffic,” said Mark Wasilefsky, head of restaurant franchise finance group at TD Bank.

Restaurants will need to consider how much of their bottom lines they are willing to sacrifice to attract and retain customers, Kristin Lynch, Paytronix’s senior director of strategy and analytics, said in Patronix’s 2025 Trend Predictions Report.

“The success of the McDonald’s $5 Meal Deal and Dunkin’s $6 Meal Deal highlighted the effectiveness of affordable, efficient deals that cater to consumers’ needs and budgets, especially as costs rise in other areas of their lives,” Lynch said.

Not all value offerings have been successful at boosting sales, however. Subway launched a $6.99 6-inch Meal Deal on Nov. 3, but ended it roughly a month early when it didn’t meet initial expectations. In January, the chain added a sub of the day deal instead, offering a rotating meal deal for specific subs for $6.99.

By contrast, brands like Portillo’s and First Watch haven’t been offering deep discounts, leaning instead on the quality of their products to provide value over price.

“In 2025, operators that offer a unique product in a price-sensitive environment will be winners,” Pielusko said. “Winners will likely include QSR and fast casual brands that can remain competitive on pricing without sacrificing the customer experience.”

Customers want quality, not just affordability

Price-conscious restaurant diners still want to ensure they are getting their money’s worth. Roughly 48% of guests said they are willing to pay more for healthier fare or specialty cuisines, according to a survey of over 1,000 adults 18 years or older from Owner.com, a technology company that helps restaurants grow their online businesses.

Thirty percent of these consumers said restaurant value has increased, while 39% said it has decreased and 31% said restaurant value has remained the same, per the Owner.com report.

“Restaurants are going to focus on your standard fare, they’re going to focus on the quality of the ingredients that they’re using,” said Isaac Gerber, Captify’s global head of data science and insights. “They’re going to focus on taste.”

This strategy could play out in the form of menu innovation and variety. Sonic updated its $1.99 menu in September with Grilled Cheese Burgers and Cream Slushes to add more variety. Del Taco added two burritos to its Real Deal$ value menu in addition to bundles in January.

Customers are focusing on positive experiences at restaurants as well, Gerber said. In the QSR sector, price is vitally important, though it’s still second to quality, he said.

“If everyone in the market has this message about value, then value compared to who? Ultimately, you’re not standing out,” Gerber said.

Consumers will remain selective with restaurants and occasions, chipping away at frequency, said Ab Igram, executive director of the Tariq Farid Franchising Institute at Babson College.

Brands will be able to stand out if they provide offers that provide more bang for their buck. The McDonald’s $5 Meal Deal, for example, offers at least three items. Papa Johns is re-focusing on the quality of its core pizza products in addition to improving its value proposition to gain an edge.

“I think their message is only going to resonate part way if their entire message is on value,” Gerber said.

Other levers operators can pull to drive traffic

Instead of just broad discounting, brands can flex their loyalty programs and provide more creative promotions to offer diners value, Julia Bigwood, Patronix manager, strategy and analytics, wrote in Patronix’s 2025 Trend Predictions Report. Chains have been using their rewards programs to gather customer data that can help them better understand purchasing behavior for more specific marketing campaigns.

“Understanding which price points and discounts resonate with different audiences, and how to diversify or creatively structure offers to drive engagement, will be crucial,” Bigwood said. “In 2025, brands will lean on creative engagement strategies to compensate for the reduction in flat discounts.”

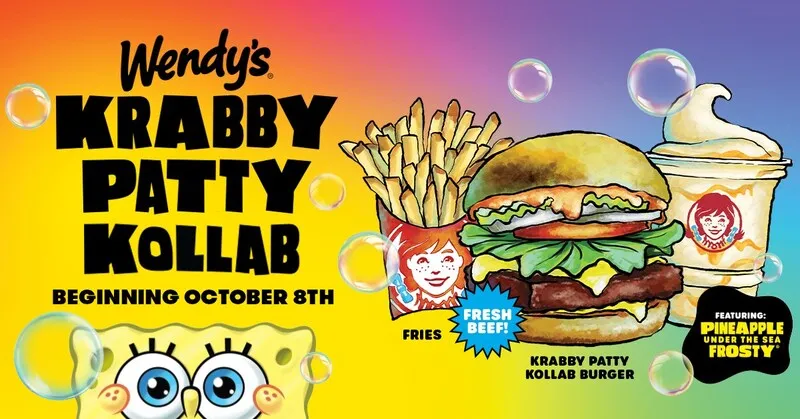

Wendy’s partnered with Nickelodeon’s SpongeBob SquarePants in October to create a Krabby Patty menu. The promotion evoked a sense of nostalgia, emphasized quality and had a unique and fun way to attract customers, she said. The promotion led to significant sales growth and boosted earned media, Wendy’s CEO Kirk Tanner said in an October earnings call.

“These creative strategies will also extend to gamifying loyalty programs, offering loyal guests and young audiences opportunities to earn rewards through gameplay,” Bigwood said.

Independent restaurants that have not played that race to the bottom do have more of an opportunity to focus on food quality messaging, Gerber said.

Full-service restaurants can also focus on improving the experience and expanding off-premise and delivery that doesn’t sacrifice quality as a way to compete against value-oriented restaurants, Pielusko said.

“If you’re investing in your customer service today, you may not see the payoff of that until six months down the line,” Gerber said. “Independents aren’t necessarily playing that [value] game either and so I think a focus on customer service could be a really interesting play for them.”