Dive Brief:

- At least four chains — Chili’s, McDonald’s, Starbucks and Buffalo Wild Wings — that added or enhanced value offerings in the past few months saw a boost in traffic, according to a Placer.ai report.

- Buffalo Wild Wings’ $20 unlimited boneless chicken wings on Mondays and Wednesdays has been a standout success as an LTO this year. The chain saw a 45.6% increase in visits on Mondays and 49.3% increase on Wednesdays from May 12 to June 29 compared to March 24 through May 11.

- Since updating its 3 for Me menu at the end of April, Chili’s has seen elevated year-over-year traffic in the double-digits, peaking at a 27.5% increase the week of May 13. Comparatively, its weekly foot traffic was up 4.7% year over year during the week before the update.

Dive Insight:

Dozens of chains have updated or added new value offerings during the past few months to boost traffic and shift consumer perception that eating out, specifically at fast food restaurants, has become a luxury.

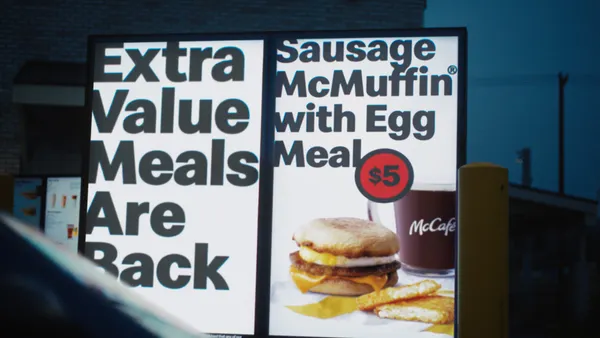

McDonald’s is among those fighting back against that perception, launching a short-term $5 Meal Deal on June 25. That launch came just weeks after McDonald’s U.S. President Joe Erlinger decried what he called were “inaccurate” and “poorly sourced” reports on how much menu prices have increased in the past several years.

These efforts are paying off, Placer.ai data shows. In the days following the $5 Meal Deal launch, traffic was elevated in the mid-single-digits compared to average foot traffic seen year-to-date on these days. Earlier in the year, McDonald’s traffic was flat or declining, according to the chain’s most recent earnings call.

While foot traffic has been up as a result of value offerings, an analyst from Morgan Stanley said it isn’t likely to have a significant impact on second quarter results at the fast food chain. McDonald’s executives said during the company’s first quarter call that it would work on a national value platform, in contrast to its previous locally-focused, franchisee-driven strategy.

Starbucks introduced a limited-time value offer on May 13: The 50% Friday discount. During the Fridays on which that discount was offered, traffic was elevated, initially peaking at 20% higher than average Friday Traffic for the year on May 14, and 12.4% higher on May 31, the last Friday of that promotional period. By contrast traffic on the Friday before the promotion started, traffic was down 1.1%, according to Placer.ai.

Compared to these temporary discounts, chains like Sonic, Del Taco, Taco Bell, Jack in the Box have extended or launched permanent value menus, which could impact traffic and sales to these chains as other discounts wind down. Following the launch of Taco Bell’s Cravings Value Menu in January, one-third of transactions at Taco Bell included one item from the menu during Q1. This menu drove a roughly 10% increase in check compared to orders without a Cravings Value item.