Dive Brief:

- Legislators in New York, New Jersey, Massachusetts and Ohio have created bills that would force insurance companies to cover businesses that have shut down due to the novel coronavirus pandemic, according to Restaurant Business. Many insurers have refused to pay restaurants with business interruption insurance because their policies exclude viral contamination, and are designed to cover tangible property damage from incidents like fires and floods.

- Massachusetts legislation would qualify restaurants with fewer than 150 employees to payment — for as long as the state's social distancing mandate remains in effect — under their business interruption policies if COVID-19 caused them to close. New Jersey's bill would pay covered restaurants with 100 or fewer employees beginning March 9. New York and Ohio's legislation would also only impact restaurants with fewer than 100 workers on payroll.

- Many policies also exclude civil authority intervention, or state and municipal governments mandating dining room closures, in this case, insuranceQuotes analyst Erik Josowitz told Restaurant Dive in a recent interview. These exclusions were put in place after the SARS/MERS epidemic in 2002, he said.

Dive Insight:

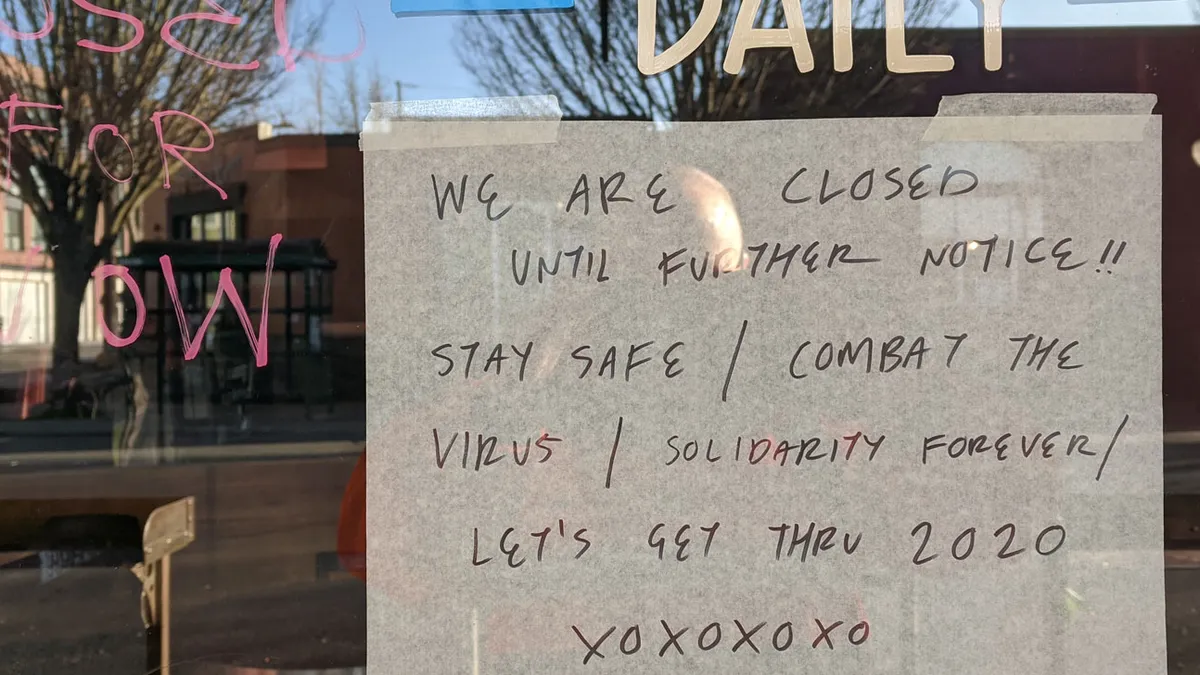

Even restaurants with comprehensive business interruption policies are struggling to receive payments after closing their doors due to state and municipal COVID-19 mandates.

The Oceana Grill, a popular tourist destination in New Orleans, Louisiana, is currently suing Lloyd's of London because the insurer refuses to pay the restaurant. Oceana Grill's business interruption policy covers "all risk" and has no exclusions of coverage due to business loss as a result of a viral pandemic. The restaurant's attorney argues that damages caused by the restaurant's shutdowns are a "real physical loss" that should be covered. Louisiana, however, restricted the operations of its courts after the suit was filed, putting proceedings on hold, Josowitz said.

Restaurants across the country are facing similar challenges with their insurance policies. The National Restaurant Association has pushed state governors to force insurers to cover restaurants with business interruption policies if they have been shut down in response to state or city safety measures. In March, the association has also petitioned the federal government to allocate funds for business interruption insurance for restaurants. It will be interesting to see if additional states roll out legislation to protect businesses amid the devastating economic effects of COVID-19, or if Ohio, New Jersey, Massachusetts and New York pass their bills into law.

It will probably be difficult for states to override pre-written business interruption insurance policies, Josowitz said, especially since many insurers insist these policies were created to cover physical property damage. It's also possible that going forward, business interruption policies for restaurants will include exclusions for viral pandemics, reflecting the insurance trend following the SARS/MERS outbreak, Josowitz said.