Panera Bread just added a bottomless jolt of caffeine to the breakfast wars.

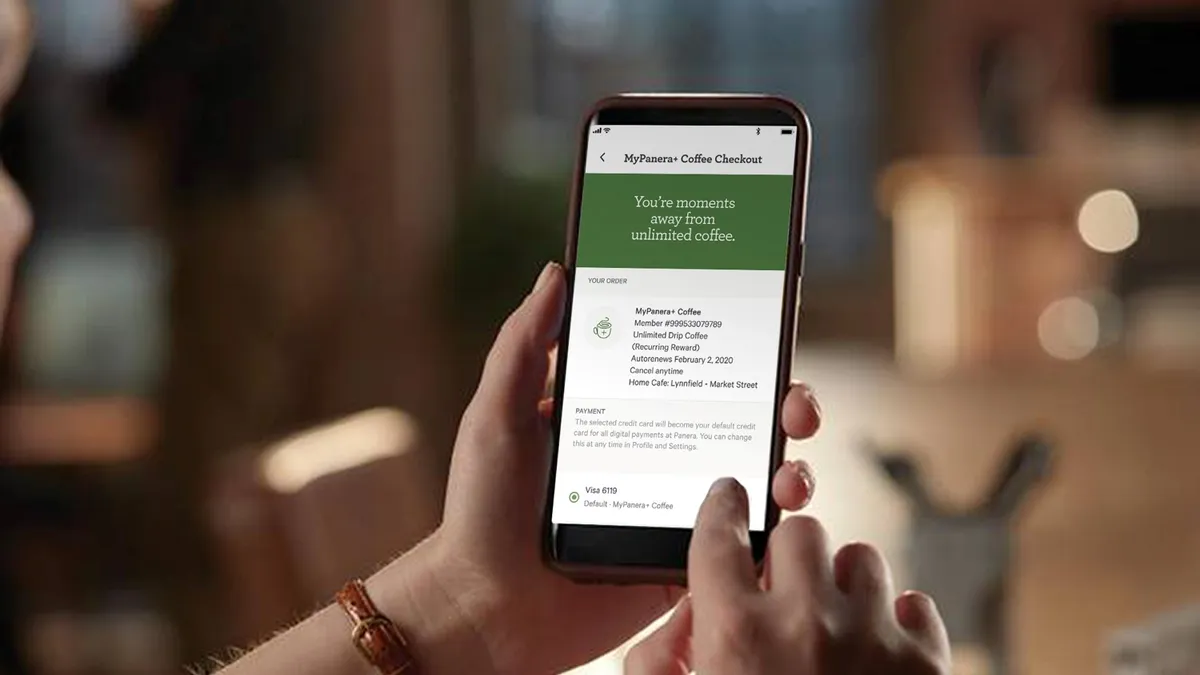

The fast casual giant launched an unlimited coffee and tea subscription for $8.99 per month on Thursday, which diners can sign up for through its MyPanera loyalty program.

The offering builds on Panera's revamped breakfast menu, which the restaurant overhauled last year to make morning meals more portable and appealing for delivery and takeaway. During the subscription's three-month pilot phase — which took place in 150 cafes in Cleveland and Columbus, Ohio, Raleigh, North Carolina and Nashville, Tennessee — the offering drove a 70% increase of diners buying food with their coffee, Panera CEO Niren Chaudhary told Restaurant Dive.

"Through the coffee program, we feel we are giving a very compelling reason for consumers to come in and try the great food at Panera … particularly the breakfast daypart," Chaudhary said.

More than 75% of redemption for coffee and tea during the pilot phase was through off-premise channels (rapid pickup, drive-thru and delivery), reflecting growing consumer demand for on-the-go breakfast. Comparatively, off-premise accounts for about 70% of Panera's overall business, according to the company.

"Consumers want frictionless experiences."

Niren Chaudhary

CEO, Panera

Because of this trend, offering streamlined, time-saving paths to purchase is "absolutely critical" to building loyalty, Chaudhary said.

"Consumers want frictionless experiences," he said. "We have omnichannel access. We have to-go, dine-in, rapid pickup, delivery, drive-thru, catering. … You just go in and redeem [coffee or tea] at any of these channels depending on what you're looking for in terms of convenience."

Chaudhary is confident that the subscription's value proposition — which could save American coffee drinkers nearly $1,000 per year — will attract new users to its rewards program. It currently has 38 million members, but that loyalty count dwarfs Starbucks' program, which counted 18.9 million active rewards members in January 2020.

During Panera's test, almost 25% of subscribers were new to MyPanera rewards.

"[Americans] like coffee, but they… feel guilty about the amount of money that they spend. I think that’s where our proposition comes in and that’s what we are solving for the consumer," he said.

The goal was to make the subscription program habit-forming, Chaudhary said. During the test, Panera experienced a 200% uptick in frequency of visits, with participants visiting Panera cafes 15-plus days per month.

Rivals are hungry for morning market share

Panera isn't the only QSR that's tried a coffee subscription offering. Burger King launched a $5-per-month unlimited program last year after overhauling its coffee suit, but it didn’t include delivery and restricted customers to redeem only small, hot coffees once per day. The burger chain discontinued the program a few months later.

By comparison, Panera's subscription can be redeemed every two hours during regular bakery-cafe hours for all coffee and tea drinks excluding cold brew, espresso and cappuccino beverages. The program is available for purchase nationwide at Panera bakery-cafes, the company's e-commerce site and the Panera app, but delivery restrictions apply. All beverage sizes are included across all dayparts.

"[Americans] like coffee, but they … feel guilty about the amount of money that they spend. I think that's where our proposition comes in and that’s what we are solving for the consumer."

Niren Chaudhary

CEO, Panera Bread

But Panera's omnichannel ecosystem, combined with the coffee expertise of parent company JAB Holdings (which also owns Peet's Coffee and Tea and Caribou Coffee) gives it an edge. In addition to signing up via Panera's website and mobile app, diners can also subscribe to the coffee program at in-store kiosks with a QR code starting Monday.

The cafe chain's subscription-style offering also aligns with consumer demands. According to the National Restaurant Association's 2020 State of the Restaurant Industry report, 68% of adults would take advantage of a house account if it was offered in a restaurant in their community. The report also found that 85% of adults would like to use that offering to buy meals and snacks from fast food restaurants or carry-out establishments.

Now that Panera's breakfast delivery is available at 693 cafes through both its own channels and third-party aggregators, it's poised to challenge both coffee rivals and major QSRs in the race for morning market share.

"There's a huge amount of growth happening in the breakfast category, which is why there's so much interest from our competitors as well,” Chaudhary said. "There is increasing need … for convenience during that daypart because [consumers] are time-pressured."

Currently, breakfast drives 10% to 15% of Panera's business depending on location and season compared to lunch, which rakes in 40% of sales.

Despite growing consumer demand for coffee and breakfast away from home, breakfast traffic could become harder to capture as more legacy chains flex new morning menus and delivery offerings.

On Monday, Wendy's will launch a breakfast menu alongside a delivery promotion. The burger brand expects sales from the morning daypart to drive 10% of its total daily sales. McDonald's also recently rolled out new breakfast chicken offerings in January to compete with Chick-fil-A and perk up slowing breakfast traffic.

Still, Chaudhary said that the combination of Panera's convenience and better-for-you food makes it a cut above competitors.

"Coffee is about optimism, at the end of the day," he said. "The whole business logic of this is [that] we feel we are solving a real dilemma that consumers have between convenience and quality. … Our role in the consumer's life is to eliminate compromise."