After several years of expansion, the novel coronavirus has pushed restaurant revenue into a freefall. In an already thin-margined business, many operators have been left without a parachute. As the days and weeks of social distancing drag on, restaurants are forced to come up with creative ways to keep the lights on in the hopes that the post-crisis economy will just be around the corner.

China didn’t begin to recover until at least two months after the government locked down the Wuhan province, where the virus first emerged. But change is coming slowly and it’s still unclear what a post-crisis economy will look like in China, let alone the U.S.

“That would be a miracle if we snap our fingers and everything is back on and people start returning to normal,” David Wender, partner in Alston & Bird’s financing restructuring and reorganization group, told Restaurant Dive.

But “normal” is going to look very different from a pre-coronavirus landscape, analysts predict. Restaurants need to act now to survive the market’s downswing and prepare for what’s on the other side of this crisis. It’s a tall order, experts warn, because brands have few financial safety nets at their disposal. But there are opportunities out there, from seeking lines of credit and government aid to negotiating cost breaks with landlords. The question is, which strategies are best?

Layoffs can provide immediate relief, but come at a cost

Looking at employees as a variable cost that can be reduced may seem to make financial sense in this environment, but for so many restaurants, workers feel like, or in some cases literally are, family, Wender said. Many operators are also wary of laying off their employees because they often lose valuable expertise.

“From a personal and relationship base, those are the hardest decisions to make,” Wender said.

Sometimes layoffs are the only option for restaurant operators with few financial resources, especially since these employees could file for unemployment insurance, experts said. Full-service brands have already taken this path, such as Union Square Hospitality Group, while others have furloughed employees, such as J. Alexander's, which is offering two-weeks of emergency pay. Cava said it would help its employees impacted by store closures find jobs in the grocery segment, and employees who return will be eligible for a new profit-sharing compensation program.

“Letting go of some staff and trying to allow the government to take care of them or assist or aid the betterment or well-being of your team is a responsible way to approach the current times,” Stephen Mancini, senior manager of strategy and transformation at CohnReznick, told Restaurant Dive. CohnReznick is an accountancy, tax and business advisory firm. “As a business owner there’s also a certain amount of risk mitigation that you should employ in your current statement of decision making because a rebound … [is] going to happen.”

It may also be worth retaining key employees who can be used in nontraditional roles, such as delivery, that could help create a revenue stream or position the company for the future so the business doesn’t have to start from scratch when things return back to normal, Mancini said.

“It’s going to be a difficult haul. If consumer confidence drags on and does not return to normal, it will be added pressure to a market that [was] already under pressure,” Wender said. “Will there be a new normal? With the old normal, restaurants were having problems.”

Talk to your partners

Since revenue is plummeting, or in some cases dried up entirely, restaurants should talk to all of their partners be that a franchisor, supplier, landlord or lenders to make financial arrangements or discounts that work for both parties. That means asking franchisors if they can come up with an arrangement to pay franchisee fees and arguing that without the franchisee, the franchisor would lose out too, Wender said.

“These are truly unprecedented times,” Wender said. “If the community comes together, we’ll get through this in the long run.”

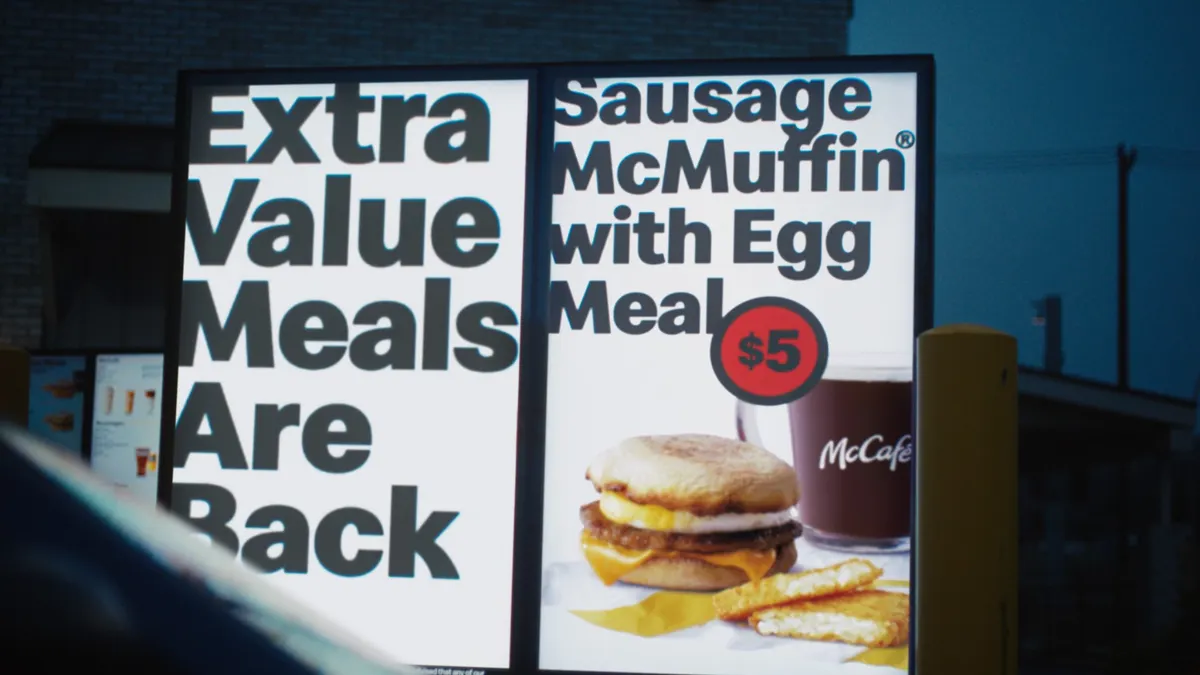

Chains like Qdoba, Subway, Chick-fil-A, Yum Brands and McDonald’s are providing relief in the form of deferral of royalties, advertising fees and rent, among other payments. Qdoba is offering eight weeks of royalty fee deferrals while Subway cut royalties in half and is helping franchisees with rent abatement, relief or deferral.

Outside of assistance from franchisors, restaurants need to talk with their landlords if they haven’t already, especially with the first of the month around the corner. Rent costs can make up anywhere from 9% to 12% of revenue, with newer entities likely to have leases that drain as much as 12% of earnings since cheaper leases were harder to come by in recent years, Mancini said. Real estate became competitive over the last two years, especially for endcaps that can allow for a drive-thru, as more chains rapidly expanded.

Restaurants can’t ignore their landlords and having conversations with them will need to be an ongoing conversation.

“[Rent] is just something that you can’t not pay,” Mancini said.

"Landlords are certainly willing to work with the tenant, but they're not going to work with the tenants without sufficient information, and just saying 'well the virus is impacting us' is not going to cut it."

Craig Ganz

Litigation partner, Ballard Spahr

Landlords have been willing to discuss options with their restaurant tenants, recognizing that they have few options as well, Cindy McLoughlin, managing partner of CohnReznick’s consumer, hospitality and manufacturing practice, told Restaurant Dive.

Initial conversations are going well. Her restaurant clients so far have found that landlords are willing to consider a variable percentage rent for several months depending on revenue stream and then making it higher at the back end, she said.

Before these conversations, tenants should have proper financial information about the company's operations so that landlords can make decisions over what kind of concessions or discounts might be possible depending on the restaurant’s previous financial history, Craig Ganz, litigation partner at Ballard Spahr, told Restaurant Dive. Ganz represents large landlords, mainly publicly traded companies that have retail and restaurant tenants.

“Landlords are certainly willing to work with the tenant, but they’re not going to work with the tenants without sufficient information, and just saying, ‘well the virus is impacting us’ is not going to cut it,” he said.

Tenants also won’t be able to ask for six months worth of concessions, and need to understand that landlords will consider things on a month-by-month basis, Ganz said.

“We also don’t know when it’s gonna end,” Ganz said. “There’s a possibility that it could end in two months or three months or it could go on longer. We just don’t know. A landlord … is only going to concede as far as they need to continue. [They are] not going to give extra rent reduction when it’s unnecessary.”

Don’t count on traditional failsafes

Restaurants are quickly discovering that traditional ways of recouping lost revenue won’t help them. Many have already received claim denials for business interruption insurance, a type of insurance that covers businesses that have to shutter operations due to a natural disaster. But this insurance usually doesn’t cover pandemics, McLoughlin said.

Others are finding that filing for bankruptcy isn’t going to help them either. CraftWorks, which filed for bankruptcy in early March, lost its debtor-in-possession and had to close its restaurants while it goes through Chapter 11 proceedings.

Typically companies that file for Chapter 11 have a specific reason to clean their balance sheets, like a lawsuit or trying to remove units that had bad leases, Wender said. This action basically allows restaurants to take away something bad from the business and restructure it around future revenue. But without future revenue, it will be difficult to get a creditor.

“The problem now is that there is almost nowhere to go,” Wender said. “Even if you’re able to replace dine-in with … robust takeaway, it’s never going to be 100% of your food revenue.”

Even so, many full-service restaurants and large chains have shifted to off-premise opportunities since that is the only way to bring in revenue.

"The problem now is that there is almost nowhere to go. Even if you're able to replace dine-in with ... robust takeaway, it's never going to be 100% of your food revenue."

David Wender

Partner, Alston & Bird

“The dynamics here are a little different than traditional delivery or takeout,” McLoughlin said.

Delivery used to be more a la carte ordering with people ordering individual meals, but with families at home, more family meals are being ordered to-go, which is creating an opportunity for higher average ticket sizes. Full-service restaurants are designing more family meals and adjusting their menus to take advantage of this opportunity, McLoughlin said. Restaurants are also simplifying their menus to help with food and labor costs, she said.

“As they can pivot to those, I think that is going to help … sustain [their businesses],” she said.

But off-premise will only be successful if the margins work, since there are still costs associated with labor, producing the food and commissions for third-party providers, Mancini said. Curbside is one way restaurants can eliminate delivery fees and can get cash in the door, Mancini said.

“It’s a math problem,” Mancini said. “As long as I’m not losing money in going off-premise, then ultimately cash coming in the door will give me some blood and … oxygen to keep on going.”

Funding options available

Many restaurants have already been pulling from their lines of credit to stay open, especially large chains like Yum Brands, The Cheesecake Factory, Darden, Bloomin’ Brands, Texas Roadhouse, Denny’s and Dine Brands to access additional cash to pay costs.

Local and federal government assistance is also in the works and could provide substantial relief, especially for independent business owners. The Senate passed a relief bill late Wednesday night that will contain $350 billion in relief for small businesses.

“This measure is an important first step to help restaurants weather the storm, take care of our employees, and prepare for when we are given the signal to open our doors once again,” Sean Kennedy, EVP of public affairs for the National Restaurant Association, said in a statement emailed to Restaurant Dive.

In addition, some states are offering tax deferrals, especially for sales tax payments, which could allow restaurants to pull from these funds, which are usually held in a trust, to tide them over until they can reopen and pay the sales tax in full, McLoughlin said. States have also extended payroll tax deadlines. California, for example, is providing a 60-day extension for businesses directly impacted by the outbreak.

Small business loans are also being offered by different states and municipalities, and some are offering interest-free loans, Ganz said.

Illinois rolled out a $90 million emergency assistance package on Wednesday to provide additional capital to small businesses, for example. That includes $14 million in grants for hospitality businesses, with eligible bars and restaurants able to receive up to $25,000. Low-interest small business loans will also be available.

While these could provide instant relief, business owners should keep in mind that they would only be adding on more debt, Ganz said.

“If you’re looking at traditional SBA type loans you’re adding more debt and that may create additional issues for everybody later on, but some do have mechanisms where they’re extremely favorable loans that may even have debt forgiveness provisions inserted in them,” Ganz said.

Prepare for the recovery now

While things may feel dire currently, restaurants should already start preparing for recovery, Mancini said. Having agility now will help restaurants be more athletic during the rebound, which Mancini said he hopes is a quick rebound versus a slower rebound.

“People are looking to take advantage of trends and opportunities created in the current state … to use as a new revenue driver moving forward,” Mancini said, which is why maintaining some employees during this time will be important.

Some restaurants have changed their menu mixes in preparation for supply chain issues and demand issues post-crisis, for example, Mancini said.

“People are preparing for the other side, meaning they are doing what they need to do now from a triage perspective, but not necessarily focusing entirely on today and in the moment,” he said.